Helb unveils simplified loan repayment methods for Kenyans abroad

The Higher Education Loans Board (HELB) has introduced a streamlined method of loan repayment, making it easier for Kenyans in the diaspora to pay back their loans.

In a post shared through their website on Thursday, June 13, 2024, the loans board outlined the procedures diaspora residents should be familiar with.

As per the institution, Kenyans residing abroad should show love for their motherland by paying up and settling their pending loans.

“Show some love to the motherland and settle those #HELBLoans. Tap, pay, repeat; it has never been easier! Visit: http://helb.co.ke,” Helb noted.

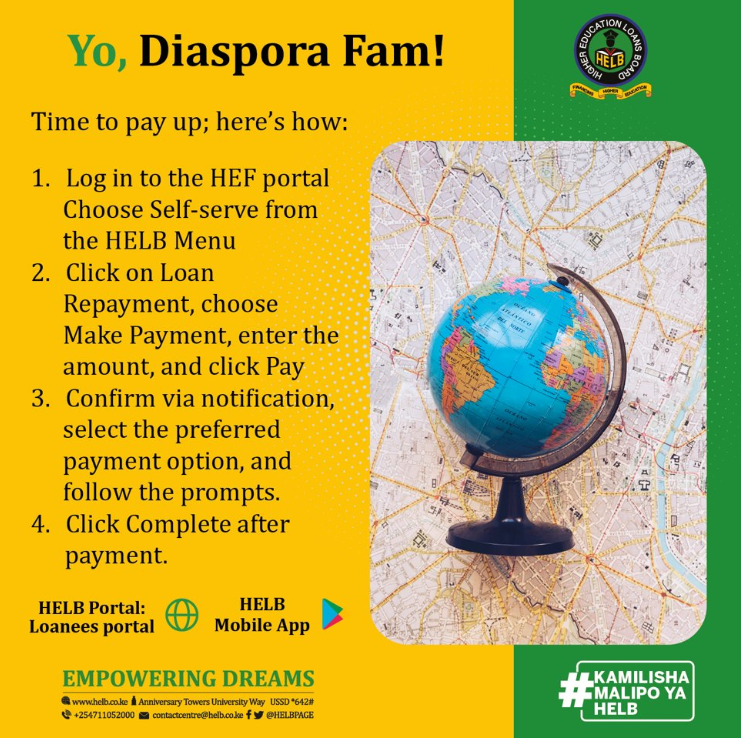

To pay back a loan, Kenyans should log in to the HEF portal and choose self-serve from the HELB menu. Then click on Loan Repayment, select Make Payment, enter the amount, and click Pay.

To complete the transaction, a confirmation message via notification will be sent, select the preferred payment option as you follow the prompts. Lastly, click complete after payment.

Helb recovery in US, UK

In 2020, and as part of Helb’s effort to increase collections from graduates, Helb hired representatives to locate defaulters abroad.

Part-time HELB brand ambassadors were recruited on a commission-based basis and only stationed in the US and UK countries where the majority of Kenya’s diaspora remittances originate.

“The ambassadors will be responsible for driving brand awareness, recovery and advocacy. They (brand ambassadors) will implement loan repayment and recovery campaigns and provide feedback on opportunities in the Diaspora,” Helb’s notice read in part.

HELB notice to Diaspora residents. PHOTO/@HELBpage/X

Deal for accrued penalties

In a recent development on Tuesday, June 11, 2024, Helb announced a new deal for the loan beneficiaries with a debt penalty.

Through a statement shared on its official social media page, the loans board set a penalty waiver for defaulters.

HELB stated that it will offer an 80 per cent penalty waiver for beneficiaries with accrued penalties who pay their loans in one lump sum.

“Pay your loan arrears in a lump sum and enjoy a waiver of up to 80% on accrued penalties,” HELB said in a statement.

Before you go…how about joining our vibrant Telegram and WhatsApp channels for hotter stories?

Telegram: https://t.me/k24tvdigital

WhatsApp: https://whatsapp.com/channel/0029VaKQnFUIXnljs50pC32O