KRA announces return of Tax Amnesty

Kenya Revenue Authority (KRA) has announced the return of the tax amnesty and urged Kenyans who have not benefited from the program to seize the opportunity.

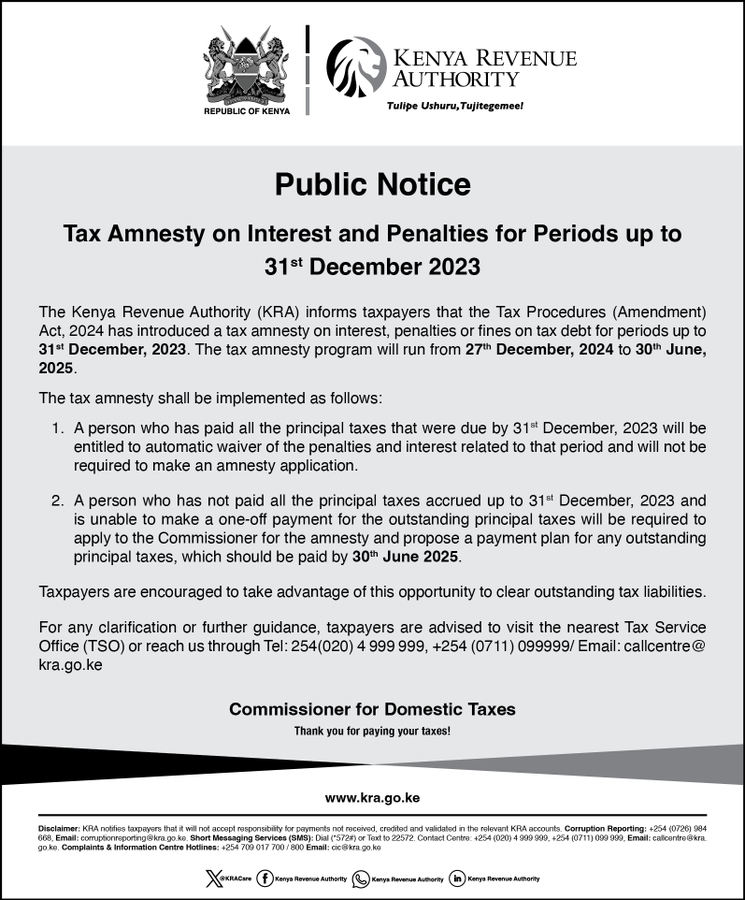

According to the taxman, the program which runs from December 27, 2024, to June 30, 2025, will be applicable on interest and penalties for tax periods up to 31st December 2023.

In the notice, KRA, on Friday, December 27, 2024, added that an automatic waiver will apply to taxpayers who’ve cleared their principal taxes.

“The Kenya Revenue Authority (KRA) informs taxpayers that the Tax Procedures (Amendment) Act, 2024 has introduced a tax amnesty on interest, penalties or fines on tax debt for periods up to December 31, 2023. The tax amnesty program will run from December 27, 2024, to 30th June 2025.

“A person who has paid all the principal taxes that were due by December 31, 2023, will be entitled to automatic waiver of the penalties and interest related to that period and will not be required to make an amnesty application,” KRA’s notice reads.

Taxpayers who have been owing the government through an outstanding principal amount that has accrued a penalty and thereby accruing interests, on or before June 30, 2025, apply for tax amnesty of the principal amount.

“A person who has not paid all the principal taxes accrued up to December 31, 2023, and is unable to make a one-off payment for the outstanding principal taxes will be required to apply to the Commissioner for the amnesty and propose a payment plan for any outstanding principal taxes, which should be paid by June 30, 2025.

“Taxpayers are encouraged to take advantage of this opportunity to clear outstanding tax liabilities,” KRA added.

Tax amnesty

This is not the first taxpayers have been pardoned through the tax amnesty program, in June 2024, KRA announced that individuals who have been owing the government through an outstanding principal amount that has accrued a penalty and thereby accruing interests, on or before December 31, 2022, can apply for tax amnesty of the principal amount.