KRA directs employers to make changes in PAYE deductions

Kenya Revenue Authority (KRA) has announced changes to Pay As You Earn (PAYE) computation.

KRA in a public notice issued via its official social media accounts on Thursday, December 19, 2024, directed employers to start making changes to PAYE deductions with effect from December 27, 2024, when the Tax Laws (Amendment) Act, 2024 takes effect.

The taxman announced three key changes that that shall be applicable in the computation of PAYE for December 2024 and subsequent periods.

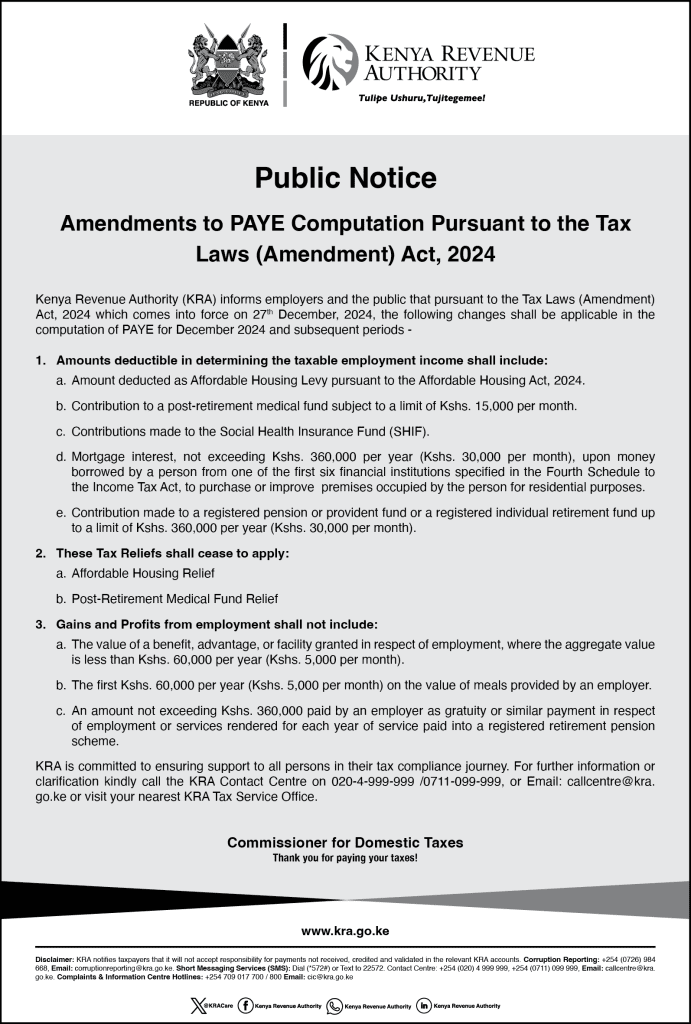

“Kenya Revenue Authority (KRA) informs employers and the public that pursuant to the Tax Laws (Amendment) Act, 2024 which comes into force on 27th December, 2024, the following changes shall be applicable in the computation of PAYE for December 2024 and subsequent periods,” the introductory part of KRA’s public notice reads.

KRA’s new changes

In the new changes, the amounts deductible in determining the taxable employment income shall include the amount deducted as Affordable Housing Levy pursuant to the Affordable Housing Act, 2024, contribution to a post-retirement medical fund subject to a limit of Ksh15,000 per month, and contributions made to the Social Health Insurance Fund (SHIF).

The amounts deductible in determining the taxable employment income shall also include mortgage interest, not exceeding Ksh360,000 per year (Ksh30,000 per month), upon money borrowed by a person from one of the first six financial institutions specified in the Fourth Schedule to the Income Tax Act, to purchase or improve premises occupied by the person for residential purposes.

It shall also include contribution made to a registered pension or provident fund or a registered individual retirement fund up to a limit of Ksh360,000 per year (Ksh30,000 per month).

KRA on Tax Reliefs

KRA in the updates also announced that the stated Tax Reliefs shall cease to apply the Affordable Housing Relief and Post-Retirement Medical Fund Relief.

“These Tax Reliefs shall cease to apply: a. Affordable Housing Relief, b. Post-Retirement Medical Fund Relief,” KRA stated.

According to KRA, the gains and Profits from employment shall not include the value of a benefit, advantage, or facility granted in respect of employment, where the aggregate value is less than Ksh60,000 per year (Ksh5,000 per month).

The taxman further stated that the gains and Profits from employment shall also not include the first Ksh60.000 per year (Ksh5,000 per month) on the value of meals provided by an employer, and an amount not exceeding Ksh360.000 paid by an employer as gratuity or similar payment in respect of employment or services rendered for each year of service paid into a registered retirement pension scheme.

The changes follows the signing into law of the Tax Laws (Amendment) Bill 2024, by President William Ruto, on December 11, 2024.