Hustler Fund: Kenyans repay Ksh7.7M hours after borrowing

At least Ksh7.7 million has been repaid two days after the Husler Fund loan product was launched, the government says.

The State had capped the repayment period for the loan for small businesses at 14 days.

Figures released by the government also show that the amount borrowed had risen to Ksh413 million as at 8:30 pm Thursday, December 1.

More than 1.6 million Kenyans have registered with the number of borrowers surpassing 880,000.

Cooperatives and MSMEs Cabinet Secretary Simon Chelugui said on Thursday morning that a total of Ksh408 million had been disbursed since the Hustler Fund was launched on Wednesday, November 30.

He indicated that at the time he issued the press conference some 1.14 million Kenyans had registered for the fund.

The loan can be accessed through USSD code *254# and the Hustler Fund application.

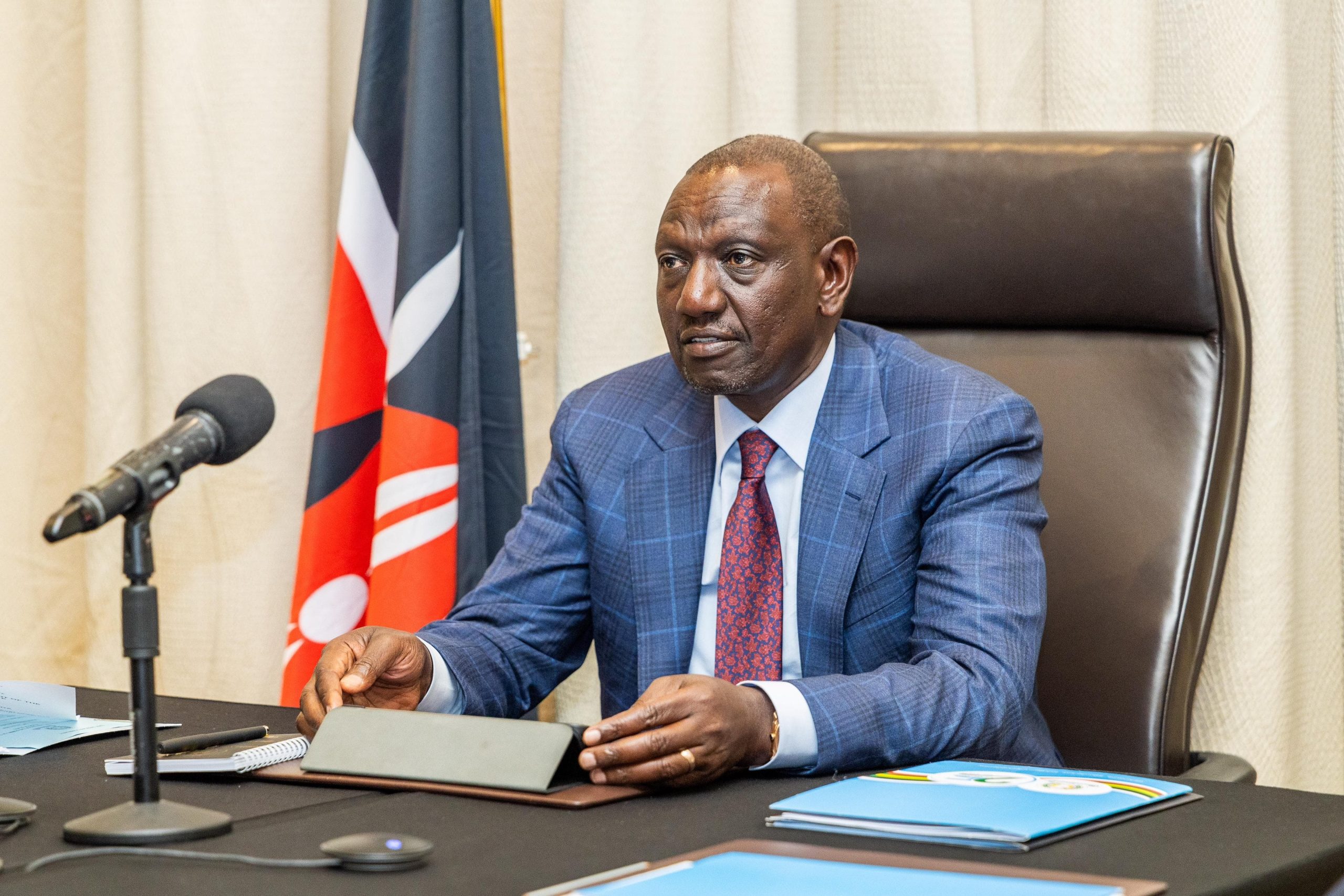

Speaking during the launch on Wednesday, President William Ruto praised the Hustler Fund program as a game changer in uplifting those at the bottom of the economic pyramid.

The President said it is different from other financial plans that were rolled out before.

Firstly, while explaining the significance of the fund, the President gave five reasons why it is more beneficial to Kenyans compared to Uwezo Fund, Youth Fund, and Women Enterprise Fund.

“We have around eight million people who have been blacklisted by all lenders. They are not allowed to borrow anywhere.

“Hustler Fund will give them a second chance to borrow again. Anyone who had been chased from other apps will have a chance to borrow money again,” he said.

Secondly, Ruto said Kenyans will not require any security for the money.

“When you borrow from another lender, you need to apply, look for guarantors, you have to know someone, get security, but Hustler Fund does not require you to look for all those things.

“It doesn’t require any committee and you should not know anyone to access it. For example, Youth Fund, Women Enterprise Fund, and others require you to go to committee, get security, but with Hustler Fund you will just need your phone and you get the money,” he added.

Thirdly, the President said the fund will be given at a low-interest rate of eight per cent (8%) per annum.

“The interest is very low. Others charge 1% per day. But Hustler Fund will charge 8% that will enable us to continue with it.

“This means Hustler Fund will charge 0.002 per cent per day down from 1% that others charge daily. So the fund is 500 per cent cheaper than the cheapest funds available in the market,” he said.

Fourthly, according to the President, the fund will allow Kenyans to save for their pension.

“Hustler Fund will enable you to save for your pension. That means your requirement will be well taken care of.

“Once you borrow, there will be an amount that will be deducted for your saving plan. The government will merge what save at a ratio of 2:1

“If you save 500 per month, which translates to 6000 per year, the Government of Kenya will give you 3000 per year. We want to ensure that every Kenyan is saving money every year,” he said.

The President said loan defaulters will not be listed on CRB, as they will have another chance of reborrowing.

“The defaulter can repay the loan at once or in instalments and begin borrowing again after full repayment,” Ruto said.