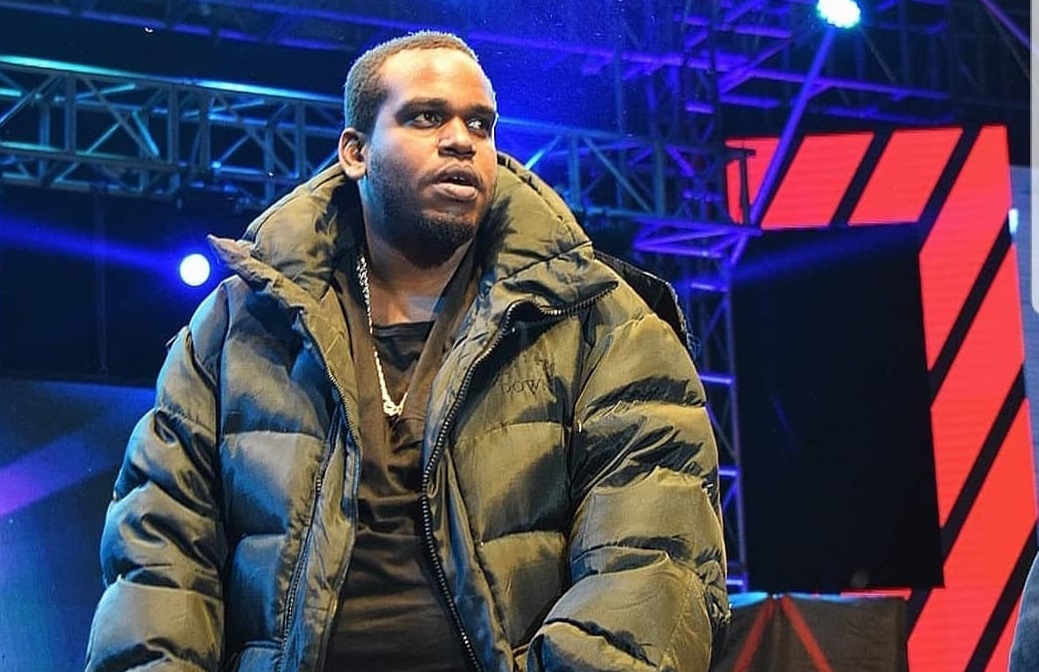

Digital Lenders Association of Kenya (DLAK) board director, Ivan Mbowa, has blamed unscrupulous newcomers in the mobile money lending sector for their ejection from credit referencing bureaus (CRBs) listing.

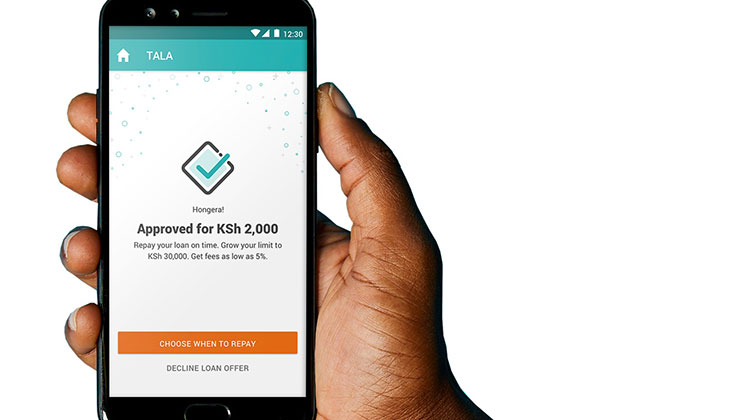

Speaking to K24 Digital on Monday, October 12, 2020, Mbowa, who is also the Tala regional manager, said that the first 15-20 digital money lenders adhere to a code of conduct that ensures that they uphold the highest standards in their operations.

“We support regulation. Not all lenders adhere to the same standards. You see this in the way some lenders do their collections from customers and defaulters. You also see this in the way some competitors structure their contracts,” said Mbowa.

The Tala official said DLAK was formed to ensures that customers are treated with humanity and dignity when it comes to loan collections and contracting.

His comments come less than a week after the Central Bank of Kenya (CBK) ejected over 337 digital money lenders from forwarding names of defaulters to CRBs.

But the Tala CEO said DLAK welcomes regulation and that its members have been at the forefront of self-regulation to ensure the strictest adherence to ethics in the manner in which they collect debts from borrowers.

The CBK ejection from CRB listing followed a public outcry over the widespread misuse of the credit information-sharing mechanism.

Some digital money lenders have been known to call or text contacts of borrowers in unscrupulous ways to force defaulters to pay back their loans.

Some even intimidate or “threat” to recover their money from close contacts of defaulters.