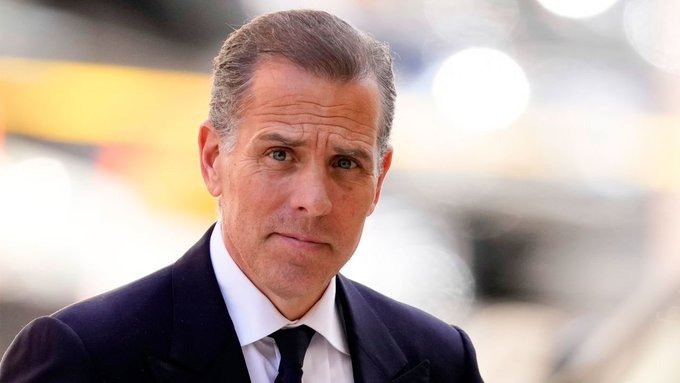

Hunter Biden makes last-minute plea in tax case

Hunter Biden has pleaded gùilty to all nine charges in his federal tàx evàsion càse, catching federal prosecutors off guard as they prepared to begin his trial.

The son of US President Joe Biden had previously denied allegations that he intentionally avoided paying $1.4m (£1m) in income tax from 2016-19.

Initially, Biden, 54, said he wanted to enter a plea where he would accept the charges while maintaining his innocence, but he agreed to plead g ùilty after prosecutors objected.

Three months ago, he was found g ùilty in a separate case of charges related to gun possession and drùg use, becoming the first criminally convicted son of a sitting US president.

The last-minute reversal in the tax case was announced in a Los Angeles court on Thursday as jury selection was about to start.

More than 100 potential jurors had gathered to begin the process of selecting the panel.

Biden’s attorney Abbe Lowell said his client wanted to forego a trial “for the sake of private interest”, sparing his friends and family from testifying about something that happened “when he was ąddicted to drùgs”.

Judge Mark Scarsi said that in pleading gùilty, Biden faces a maximum penalty of 15 years in prison and fines ranging from $500,000 to $1m.

He is due to be sentenced on 16 December, a month after the White House election and a month before his father leaves office.

President Biden has previously said he would not use executive power to pardon his son.

There is a portrait of the president in each federal courthouse in the country, and Biden holding hands with his wife, Melissa Cohen Biden along with his lawyers and a Secret Service detail had to walk by the picture of his father for the hearing.

The prosecution – representing the Biden administration’s justice department – said they were “shocked” by the suggested Alford plea and reluctant to agree to the deal if it allowed Hunter Biden to maintain his innocence.

They said the defendant was “not entitled to plead gùilty on special terms that apply only to him”.

“Hunter Biden is not innocent. Hunter Biden is gùilty,” lead prosecutor Leo Wise said.

“We came to court today to try this case.”

Once prosecutors finished reading aloud the entire 56-page indictment against him to the court, the judge asked Biden if he agreed that he had “committed every element of every crime charged.”

“I do,” Biden said.

Biden previously sought to have the case thrown out, arguing that the justice department’s investigation was motivated by politics and that he was targeted because Republican lawmakers were working to impeach his father.

Prosecutors had said they wanted to introduce evidence about the defendant’s overseas business dealings, which have been the focus of Republican lawmakers’ investigations into alleged influence-peddling by the Biden family. The White House denies wrongdoing.

Hunter Biden also argued that the special counsel on the case, David Weiss, had been appointed unlawfully.

These arguments were dismissed by Judge Scarsi, who was appointed by former President Donald Trump.

Biden was charged with three felony tax offences and six misdemeanour offences in December. These included failure to file and pay his taxes, tax evasion and filing a false return.

The indictment detailed how Biden earned $7m in income from his foreign business dealings between 2016-19.

He spent nearly $5m during that period on “everything but his taxes”, said the indictment.

Those purchases included drùgs, escorts, lavish hotels, luxury cars and clothing, which Biden falsely labelled as business expenses.

Prosecutors said Biden’s actions amounted to “a four-year scheme”.

“In each year in which he failed to pay his táxes, the defendant had sufficient funds available to him to pay some or all of his outstanding táxes when they were due,” the indictment said. “But he chose not to pay them.”

President Biden did not respond to reporters’ questions about his son’s case as he returned to the White House on Thursday evening from an official trip to Wisconsin.

Hunter Biden first agreed to plead gùilty in Delaware last year to misdemeanour tax offences, but that agreement fell apart after another judge said elements of it were unusual.

His tax evasion case marks the second federal criminal case for him this year.

In June, he was convicted on three felony charges connected to his purchase of a revolver in 2018 while battling a drùg áddiction, and lying about his drùg use on a federal form to buy the gun.