Pain for gamblers as government proposes hike of betting tax to 20%

Gamblers have yet again been hit after the government’s latest move to hike taxes on betting, gaming and lotteries.

Treasury Cabinet Secretary Njuguna Ndung’u on Thursday, June 13, 2024, proposed to increase the betting and gambling excise duty tax rate to 20 per cent.

Speaking before the National Assembly during the reading of the 2024/205 Financial Year budget statement, CS Ndung’u said the youth’s participation in betting, gaming and lotteries has continued to affect the social economic fabric of the society.

Discourage betting

According to the CS, increasing the excise duty rate on betting and gambling will discourage people from participating.

CS Ndung’u attributes the government’s move to the addictive nature of betting and gambling.

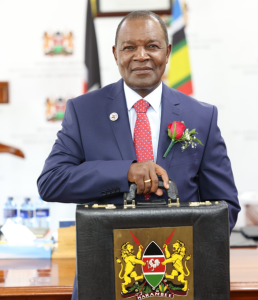

Treasury CS Njuguna Ndung’u presenting the 2024/2025 FY budget statement at Parliament on June 13, 2024. PHOTO/@keTreasury/X

“Participation in betting, gaming, lotteries continues to affect the social economic fabric of our society given the addictive nature,” he said.

CS Ndung’u noted that the government had raised the tax rate from 7.5 per cent during the last Financial Year, to 12.5 per cent, but despite the increase, Kenyans have continued to participate.

Betting among children

He says the exercise has been also attracting school-going children.

“Last year we raised the excise duty on these activities from 7.5 per cent to 12.5 per cent, do discourage participation but despite this increase, the participation rate by Kenyan citizens including the school-going children and young adults continues to rise. To further discourage this behaviour, I propose to increase the excise duty tax rate to 20 per cent,” CS Ndung’u said.

Betting tax controversy

Last year, the government increased the tax on betting and gaming stakes from 7.5 per cent to 12.5 per cent from July 1, 2023.

The stake tax has been a long-standing subject of controversy, which was exacerbated by a decision to double the rate from 10 per cent to 20 per cent in 2019.

Treasury CS Njuguna Ndung’u holding the budget briefcase. PHOTO/@KeTreasury/X

However, in 2020, the Parliamentary Finance Committee noted that the higher rate had led to lower tax revenue, in part as a result of market exits.

The committee then proposed scrapping the tax entirely, a proposal that was accepted and signed into law by then-President Uhuru Kenyatta.

The then National Treasury CS Ukur Yatani then immediately said that the tax should never have been scrapped and reintroduced it in 2021.

In the 2021 Finance Bill, the government set the excise duty at 20 per cent of the amount wagered or staked on betting products.

However, the Finance Committee again made changes, this time reducing the stake levy to 7.5 per cent which was then retained in the 2022 fiscal year and signed into law.

It was later raised to 12.5 per cent, and the treasury has yet again proposed a further increase to 20 per cent, a rate that was highly contested by Members of Parliament in 2020.

Before you go…how about joining our vibrant Telegram and WhatsApp channels for hotter stories?

Telegram:https://t.me/k24tvdigital

WhatsApp:https://whatsapp.com/channel/0029VaKQnFUIXnljs50pC32O