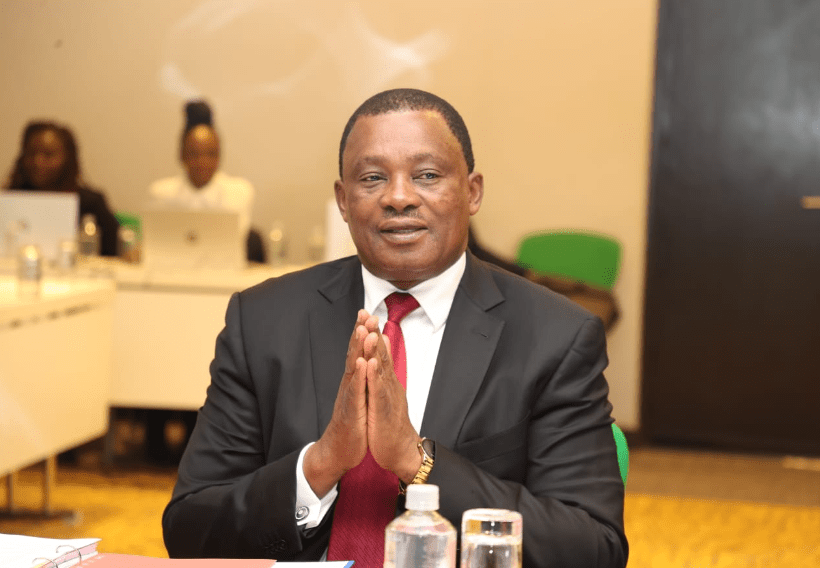

ZACHARY OCHUODHO

The shilling yesterday dipped for the third consecutive day to hit 103.65 against the US dollar even as Monetary Policy Committee (MPC) meets today to review the prevailing macro-economic conditions and set the benchmark lending rate for the next two months.

Experts attributed the drop of the shilling against the US dollar partly to market jitters about the arrest of senior government officials including National Treasury Cabinet Secretary, Henry Rotich which has created a power vacuum in the ministry, albeit temporarily.

John Kirimi, Director Sterling Capital, said besides the normal fundamentals such as budget and trade deficits, which affect the stability of a currency of a country, there is also, the normal market sentiments when market-sensitive occurs or are reported.

He said there is a link between financial stability, inflation, foreign exchange market, market stability and stable macro-economic stability.

“Depreciation of the shilling against the major currencies can also cause inflation since Kenya is a net importer of goods. Inflation can also be caused by factors that influence the demand for goods and services, such as amount of money ordinary people have available to spend,” Kirimi added.

However, Caleb Mugendi, Assistant Investment Manager at Cytonn said a number of factors including the demonetisation process and sour investor sentiments caused by the charges against Treasury officials.

Meanwhile, analysts predict that the Central Bank’s MPC will retain the benchmark lending rate at 9 per cent.

If the Central Bank Rate is retained at 9 per cent, the rate will have run for a year since it was last reduced from 9.5 per cent on May 28, 2018.

Mugendi said he expects MPC to retain current policy stance, citing stable macro-economic environment, low inflation and adequate forex reserves.

![Digital lending apps are leaving millions of Kenyans trapped in indebtedness, an expert has told the BBC. [PHOTO | COURTESY]](https://k24.digital/wp-content/uploads/2019/05/money.jpg)