Molo MP explains circumstances that could force govt to raise taxes in Finance Bill 2025

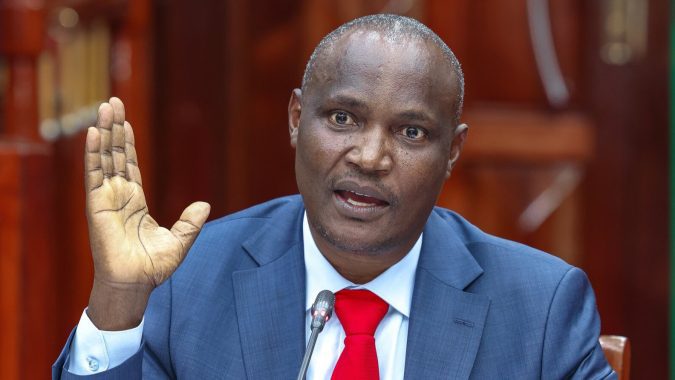

By Lutta Njomo, April 8, 2025Molo Member of Parliament Kuria Kimani, who doubles up as the Chair of the Finance Committee, has explained the circumstances that would compel the government to introduce the Finance Bill 2025 aimed at raising more taxes or retain the current rates.

Speaking to a local TV station, on Tuesday, April 8, 2025, Kuria Kimani stated the decision would be arrived at after the National Treasury presents a report detailing whether the existing tax measures and revenue generated would be able to finance the country’s budget for the next financial year.

The lawmaker argued that the Treasury is expected to give an account of appropriation aid (money generated when the government charges people for particular services) and how much is projected to be collected in the 2025/26 financial year.

He added that data on ordinary revenue collected and commitment in donor funding would help decide whether to introduce Finance Bill 2025 with more tax-raising measures or retain the current rates.

Kuria Kimani made it clear that if the records on appropriation aid, ordinary revenue and donor funding commitment prove enough to finance the budget, then the government would not introduce new tax measures.

“National Treasury has data on all that information, and we won’t have that data until towards the last quarter, that is why April 30 is very important. This is to say this is how much we have raised in the appropriation aid and this is how much we anticipate to raise in the next financial year, this is how much we have generated in terms of ordinary revenue now, this is how much commitment we have in terms of donor funding now and so the question is, is that sufficient to finance the budget?” Kuria Kimani posed.

“In the event that is not sufficient that is when there will be additional tax measures to raise additional revenue to finance that particular budget.”

“But in the event that there is empirical evidence to show that there is already existing tax measures, appropriations aid, and the donor commitment that we have is sufficient to finance the ceilings, then there would be no need for a finance bill,” he told a local TV station.

His sentiments came after President William Ruto’s cabinet approved a Ksh4.5 trillion spending plan for the period starting July 1, 2025.

In 2024, Kenya had a Ksh3.9 trillion budget, which forced the government to introduce Finance Bill 2024 sparking protests across the country over more tax measures contained therein.

After a series of protests, Ruto returned the passed Finance Bill 2024 to parliament, which was then dropped in its entirety.

Positive report on appropriation aid

With the expected changes, Kuria Kimani raised optimism, indicating that the government had recorded a growth in appropriation aid collection.

He argued that if Kenya secures more donor funds, then there will be no need to introduce a new finance bill

“The question we will be asking is, are the current tax measures sufficient to finance the increment in expenditure? Another source of income for the expenditure side is what we call appropriation and aid. We have seen a big jump in our appropriations aid. Appropriation aid is income generated when the government charges you for particular services, like when you apply for a passport or you visit a game park,” Kuria explained.

“We have seen sufficient growth in appropriations aid. We would be watching on the spike of donor-funded projects – how much we have received in terms of donations,” he added.

Mbadi’s past sentiments

Treasury Cabinet Secretary John Mbadi had in November 2024 hinted at plans not to introduce the Finance Bill in 2025.

Mbadi told a local TV station then that his ministry was contemplating avoiding another Finance Bill before the implementation of the current one, so that it can continue unburdening Kenyans.

According to the CS, the Treasury’s policy of upholding the principle of taxes as predictable and certain to taxpayers called for deliberation to strike a balance in ensuring revenue collection is fair to all Kenyans.

“A tax should be predictable and certain but you must also balance it off with other principles of taxation one of which is simplicity and the other is fairness,” Mbadi said.

“It is in our tax policy to make sure that tax is predictable and that is why we have said we will not be making many changes to our tax laws. As a matter of fact, we are even discussing at the treasury whether next year we should just avoid bringing anything called Finance Bill at all.”