‘Ruto must go!’ – Protestors chant ahead of Finance Bill 2024 tabling

MPs attending Parliamentary sessions on Tuesday, June 18, 2024, were treated to chants of “Ruto must go” from protestors opposing the Finance Bill 2024.

The angry protestors filled Parliament Road to express their anger against the Finance Bill 2024, which is seeking to add more financial burden to taxpayers.

No one was hurt during the protests, although several people were arrested by the police.

Due to public pressure, the government was forced to do away with some of the taxes that were initially proposed in the Bill.

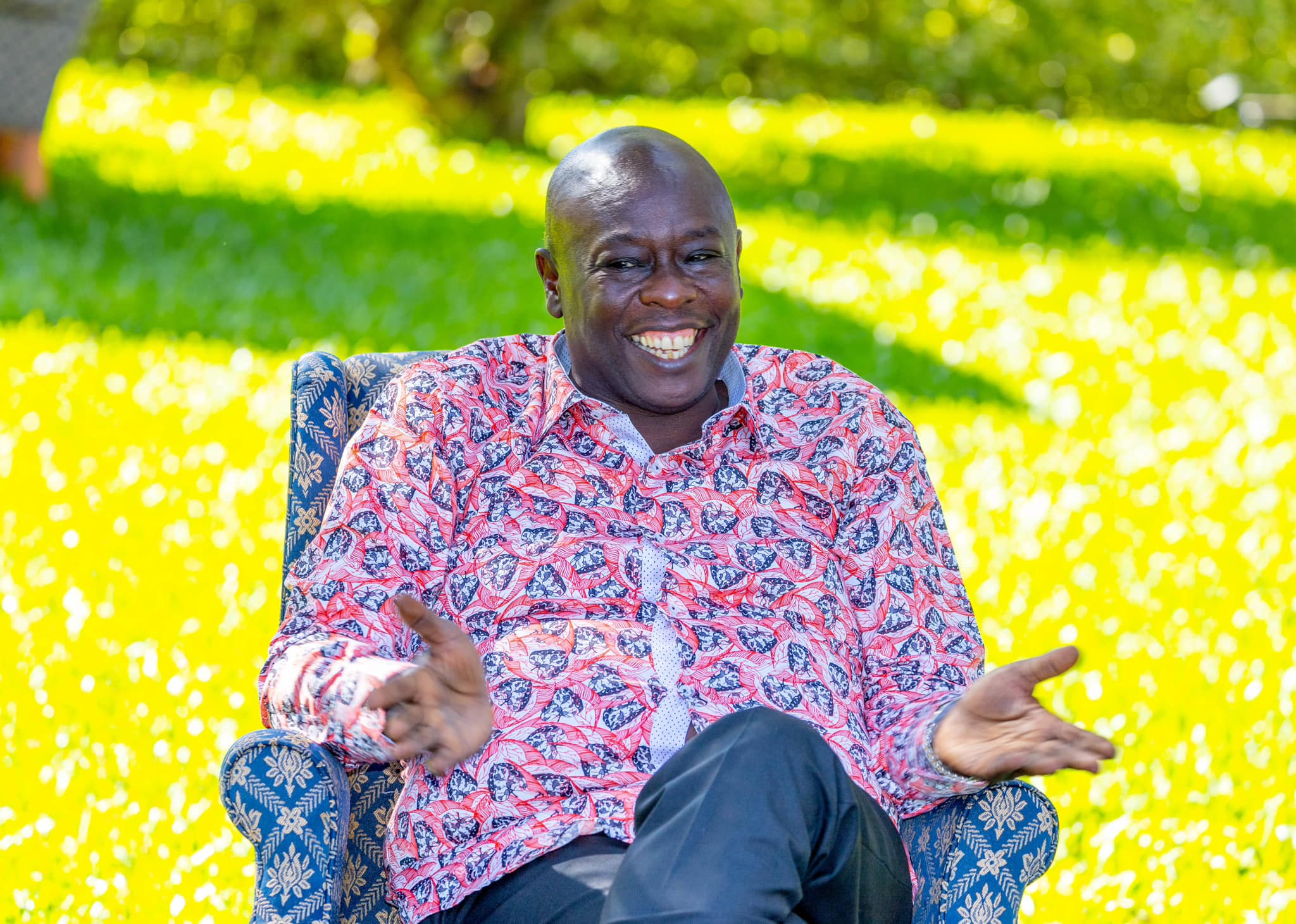

On Tuesday, June 18, 2024, the National Assembly’s Finance and Planning Committee Chairperson Kimani Kuria announced changes to the Finance Bill 2024.

The changes, announced hours before the Bill is tabled in Parliament, will see a number of tax proposals scrapped after pressure from members of the public and lobby groups.

Among the levies scrapped from the Bill include the 16 per cent VAT on bread, the Eco Levy on some items and the hike of taxes on mobile money transfers.

“The proposed 16 per cent VAT on bread has been removed. VAT on the transportation of sugar has also been removed. VAT on financial services and foreign exchange transactions has also been removed,” Kuria said.

Kuria also announced that the proposed Motor Vehicle Tax has also been removed.

Kuria further stated that to support the reduction of the cost of living Kenya Kwanza parliamentary group have come up with a way of making edible oil less expensive.

“Excise duty on vegetable oil removed,” he disclosed.

Levies on housing funds and Social Health Insurance (SHI) will be voluntary.

“Levies on the Housing Fund and Social Health Insurance will become income tax deductible. This means the levies will not attract income tax, putting much more money in the pockets of employees,” he disclosed.

In a new directive, Eco Levy will be levied on imported finished products. Locally manufactured products will, therefore, not attract the Eco Levy.

Before you go…how about joining our vibrant Telegram and WhatsApp channels for hotter stories?

Telegram: https://t.me/k24tvdigital

WhatsApp: https://whatsapp.com/channel/0029VaKQnFUIXnljs50pC32O

Author

Francis Muli

Francis Muli is a passionate digital journalist with over seven years of experience in crafting compelling stories across various platforms. His major focus is in business, politics and current affairs. He brings a keen eye for detail and a commitment to uncovering the truth. He has contributed to leading publications across the country. When not chasing stories, you can find Muli exploring new technologies, attending local events, or reading fiction. Connect with Francis Muli on X @FMuliKE and Facebook (Francis Muli) to follow his latest stories and insights.

View all posts by Francis Muli